-

There has been a recent cluster of spammers accessing BARFer accounts and posting spam. To safeguard your account, please consider changing your password. It would be even better to take the additional step of enabling 2 Factor Authentication (2FA) on your BARF account. Read more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2020 Investment Thread

- Thread starter afm199

- Start date

- Status

- Not open for further replies.

DesiDucati

Veteran

Couldn’t you tell Disney is hurting because of the Pandemic, no one likes their garbage movies, no one subscribed to their channel, and no one going to their parks? I hope it goes back down below 100.

DesiDucati

Veteran

Sorry for monster pics

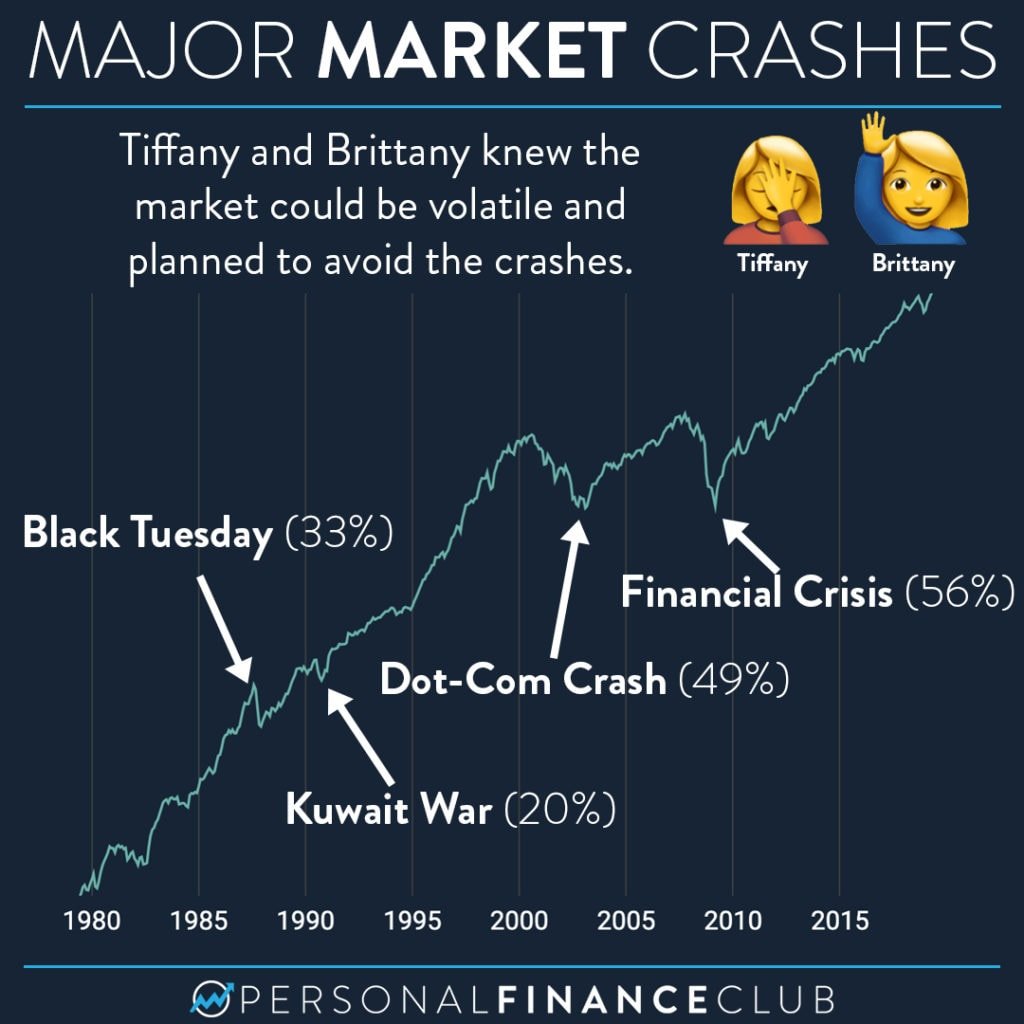

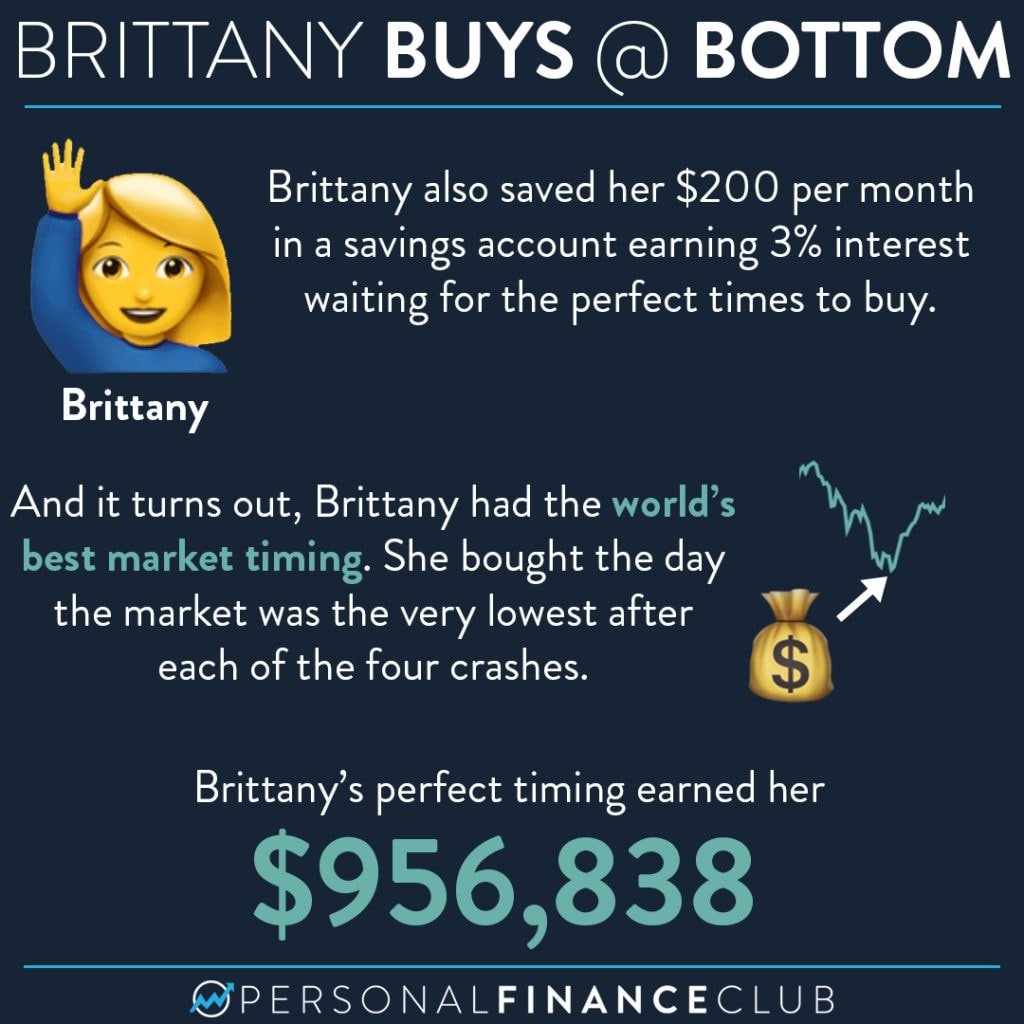

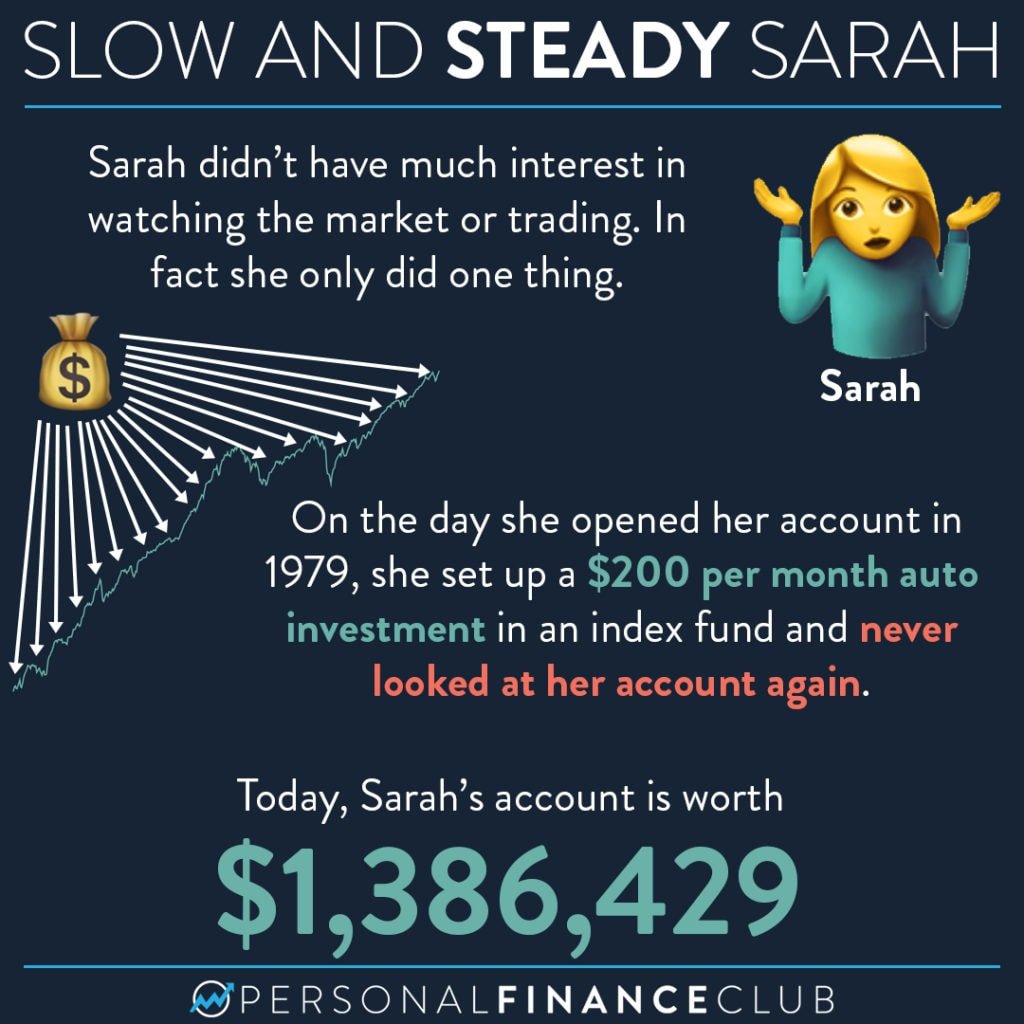

Aren’t these pictures made by the fund managers though? So there’s also impulsivity bias?

900ss

Well-known member

Aren’t these pictures made by the fund managers though? So there’s also impulsivity bias?

You will get similar if not the same advice from very savvy and experienced investors who have no skin in the game.

What do you folks like for relatively safe dividends with good price/return ratios? Here are some I was looking at with dollars spent purchasing one share today relative to dollars received in dividends over the last two years.

ADX: $16.42/$3.35 (4.9:1)

VDIGX: $31.18/$3.35 (9.3:1)

SCHD: $57.29/$3.56 (16.1:1)

SPY: $339.43/$11.17 (30.4:1)

AMT: $242.28/$7.94 (30.5:1)

VTI: $174.19/$5.61 (31:1)

VOO: $312.84/$10.78 (39.4:1)

Making $850/mo for every 100k on ADX sounds pretty sweet...

Adding Pete's list. Again, over two years..

F: $7.23/$1.05 (6.9:1)

NVS: $85.94/$5.61 (15.3:1)

MCD: $226.48/$9.64 (23.5:1)

INTC: $52.67/$2.55 (20.7:1)

DUK: $91.30/$7.53 (12.2:1)

PEAK: $28.34/$2.96 (9.6:1)

BEP: $53.11/$3.44 (15.4:1)

JNJ: $147.88/$7.62 (19.4:1)

DFS: $63.72/$3.40 (18.7:1)

T: $28.80/$4.10 (7.0:1)

ABBV: $87.07/$9.85 (8.8:1)

BTI: $35.48/$5.42 (6.5:1)

ET: $5.49/$2.44 (2.25:1)

MED: $164.49/$7.52 (21.9:1)

BMY: $60.42/$3.44 (17.6:1)

CPB: $48.25/$3.15 (15.3:1)

ADX: $16.42/$3.35 (4.9:1)

VDIGX: $31.18/$3.35 (9.3:1)

SCHD: $57.29/$3.56 (16.1:1)

SPY: $339.43/$11.17 (30.4:1)

AMT: $242.28/$7.94 (30.5:1)

VTI: $174.19/$5.61 (31:1)

VOO: $312.84/$10.78 (39.4:1)

Making $850/mo for every 100k on ADX sounds pretty sweet...

Adding Pete's list. Again, over two years..

F: $7.23/$1.05 (6.9:1)

NVS: $85.94/$5.61 (15.3:1)

MCD: $226.48/$9.64 (23.5:1)

INTC: $52.67/$2.55 (20.7:1)

DUK: $91.30/$7.53 (12.2:1)

PEAK: $28.34/$2.96 (9.6:1)

BEP: $53.11/$3.44 (15.4:1)

JNJ: $147.88/$7.62 (19.4:1)

DFS: $63.72/$3.40 (18.7:1)

T: $28.80/$4.10 (7.0:1)

ABBV: $87.07/$9.85 (8.8:1)

BTI: $35.48/$5.42 (6.5:1)

ET: $5.49/$2.44 (2.25:1)

MED: $164.49/$7.52 (21.9:1)

BMY: $60.42/$3.44 (17.6:1)

CPB: $48.25/$3.15 (15.3:1)

Last edited:

NorCalAthlete

O_o

What do you folks like for relatively safe dividends with good price/return ratios? Here are some I was looking at with dollars spent purchasing one share today relative to dollars received in dividends over the last two years.

ADX: $16.42/$3.35 (4.9:1)

VDIGX: $31.18/$3.35 (9.3:1)

SCHD: $57.29/$3.56 (16.1:1)

SPY: $339.43/$11.17 (30.4:1)

AMT: $242.28/$7.94 (30.5:1)

VTI: $174.19/$5.61 (31:1)

VOO: $312.84/$10.78 (39.4:1)

Making $850/mo for every 100k on ADX sounds pretty sweet...

Dividend stocks I've seen recommended over the last year or so:

F:

NVS:

MCD:

INTC:

DUK:

PEAK:

BEP:

JNJ:

DFS:

T:

ABBV:

BTI:

ET:

MED:

BMY:

900ss

Well-known member

What do you folks like for relatively safe dividends with good price/return ratios? Here are some I was looking at with dollars spent purchasing one share today relative to dollars received in dividends over the last two years.

ADX: $16.42/$3.35 (4.9:1)

VDIGX: $31.18/$3.35 (9.3:1)

SCHD: $57.29/$3.56 (16.1:1)

SPY: $339.43/$11.17 (30.4:1)

AMT: $242.28/$7.94 (30.5:1)

VTI: $174.19/$5.61 (31:1)

VOO: $312.84/$10.78 (39.4:1)

Making $850/mo for every 100k on ADX sounds pretty sweet...

Re: ADX, too bad I didn't buy that dip at the end of March. Aah, hindsight.....

afm199

Well-known member

What do you folks like for relatively safe dividends with good price/return ratios? Here are some I was looking at with dollars spent purchasing one share today relative to dollars received in dividends over the last two years.

ADX: $16.42/$3.35 (4.9:1)

VDIGX: $31.18/$3.35 (9.3:1)

SCHD: $57.29/$3.56 (16.1:1)

SPY: $339.43/$11.17 (30.4:1)

AMT: $242.28/$7.94 (30.5:1)

VTI: $174.19/$5.61 (31:1)

VOO: $312.84/$10.78 (39.4:1)

Making $850/mo for every 100k on ADX sounds pretty sweet...

ADX is an interesting purchase, I've held it off and on for years. Also the oldest fund in America.

It has upsides and downsides. It has a stipulated purpose of high return dividends, which are sometimes met by selling appreciated shares. It's more market sensitive than many funds. It's also selling at a nice discount. Right now a bit rich for my blood, but who knows, this may be the low point, lol.

Like I said, owned it off and on for many years and never regretted. Remember that you are buying into the December dividend, typically they will have four small dividends and one December large dividend to meet their goals. That also reduces the price by the dividend amount, which means you will see the NAV go down a couple bucks when the dividend issues. Every year this happens. Just something to remember, the dividends are small all year until December. And you won't see much growth, at all. It's strictly dividend CEF. What does that mean? The fund started at $10 a share in 1929, reached a high of $30 in 2000, and currently is selling for $16.50. On the other hand, the dollar in 1929 was worth $15.19 of today's, so there's a pretty good indication that ADX is not going to gain in share price, but be of value for dividend.

PS: Don't be fooled by ADX. That dividend return is not happening every year. The company stipulates that they will return 6% yearly minimum and often return more. But that's more like $500 a month, not $800.

Last edited:

scootergmc

old and slow

- Joined

- Aug 14, 2003

- Location

- Land of cows and silage

- Moto(s)

- Honda HT3813 (x2), Cub Cadet 147,

Oliver 1655, Super 88,

Cat 15 (x2)

I have a chunk in VDIGX, in it for the long term.

Dividend stocks I've seen recommended over the last year or so:

Thanks Pete. I added these to my post above. That ET is a big red flag, or, it's a go-into-this-eyes-wide-open kinda dividend.

Re: ADX, too bad I didn't buy that dip at the end of March. Aah, hindsight.....

Man I kick myself so often. If I'd have done what I should have done just ten years ago...

ADX is an interesting purchase, I've held it off and on for years. Also the oldest fund in America.

It has upsides and downsides. It has a stipulated purpose of high return dividends, which are sometimes met by selling appreciated shares. It's more market sensitive than many funds. It's also selling at a nice discount. Right now a bit rich for my blood, but who knows, this may be the low point, lol.

Like I said, owned it off and on for many years and never regretted. Remember that you are buying into the December dividend, typically they will have four small dividends and one December large dividend to meet their goals. That also reduces the price by the dividend amount, which means you will see the NAV go down a couple bucks when the dividend issues. Every year this happens. Just something to remember, the dividends are small all year until December. And you won't see much growth, at all. It's strictly dividend CEF. What does that mean? The fund started at $10 a share in 1929, reached a high of $30 in 2000, and currently is selling for $16.50. On the other hand, the dollar in 1929 was worth $15.19 of today's, so there's a pretty good indication that ADX is not going to gain in share price, but be of value for dividend.

PS: Don't be fooled by ADX. That dividend return is not happening every year. The company stipulates that they will return 6% yearly minimum and often return more. But that's more like $500 a month, not $800.

From what I've read about it, it seems like the only stock I've found that hits that sweet spot of killer returns with a high degree of safety. They seem to very roughly track the market over the last ten years, to a lesser degree of course, and yes I see the big december drop from the dividend, which is actually way more than the dividend itself, so I'm considering diving in at the december drop and forego the dividend for this year. But it is odd how the trend you describe has developed over the last few years. Anyway, I like it and will probably give it a try.

I have a chunk in VDIGX, in it for the long term.

Can't go wrong with this one.

CPB has a 2.88% dividend yield, and the price is right. I'd buy it if I hadn't already.

INTC is at 2.57% and still well below its historical price trend. Got that one too.

Campbell's is good. You could do better with VDIGX and even less risk.

NorCalAthlete

O_o

Thanks Pete. I added these to my post above. That ET is a big red flag, or, it's a go-into-this-eyes-wide-open kinda dividend.

Thanks, was posting from mobile. Now that I'm back on desktop....let me see here...

ET |$5.49|$2.44|2.25

ADX |$16.42 |$3.35 |4.9

BTI |$35.48 |$5.42 |6.5

F |$7.23 |$1.05 |6.9

T |$28.80 |$4.10 |7

ABBV |$87.07 |$9.85 |8.8

VDIGX |$31.18 |$3.35 |9.3

PEAK |$28.34 |$2.96 |9.6

DUK |$91.30 |$7.53 |12.2

NVS |$85.94 |$5.61 |15.3

CPB |$48.25 |$3.15 |15.3

BEP |$53.11 |$3.44 |15.4

SCHD |$57.29 |$3.56 |16.1

BMY |$60.42 |$3.44 |17.6

DFS |$63.72 |$3.40 |18.7

JNJ |$147.88 |$7.62 |19.4

INTC |$52.67 |$2.55 |20.7

MED |$164.49 |$7.52 |21.9

MCD |$226.48 |$9.64 |23.5

SPY |$339.43 |$11.17 |30.4

AMT |$242.28 |$7.94 |30.5

VTI |$174.19 |$5.61 |31

VOO |$312.84 |$10.78 |39.4

Sorted from best to worst ratio. Still figuring out table code on this forum so this took a bit of experimenting...

edit - also, here's MarketWatch on ET

https://www.marketwatch.com/investing/stock/et

Last edited:

jt2

Eschew Obfuscation

You might consider adding Altria (MO) to that list. 8.69% dividend.

Thanks, was posting from mobile. Now that I'm back on desktop....let me see here...

Ticker |Price |Avg Div |Ratio

ET |$5.49|$2.44|2.25

ADX |$16.42 |$3.35 |4.9

BTI |$35.48 |$5.42 |6.5

F |$7.23|$ 1.05 |6.9

T |$28.80 |$4.1 |7

ABBV |$87.07 |$9.85 |8.8

VDIGX|$31.18 |$3.35 |9.3

PEAK |$28.34 |$2.96 |9.6

DUK |$91.30 |$7.53 |12.2

NVS |$85.94 |$5.61 |15.3

CPB |$48.25 |$3.15 |15.3

BEP |$53.11 |$3.44 |15.4

SCHD |$57.29 |$3.56 |16.1

BMY |$60.42 |$3.44 |17.6

DFS |$63.72 |$3.4 |18.7

JNJ |$147.88 |$7.62 |19.4

INTC |$52.67 |$2.55 |20.7

MED |$164.49 |$7.52 |21.9

MCD |$226.48 |$9.64 |23.5

SPY |$339.43 |$11.17 |30.4

AMT |$242.28 |$7.94 |30.5

VTI |$174.19 |$5.61 |31

VOO |$312.84 |$10.78 |39.4

Sorted from best to worst ratio. Still figuring out table code on this forum so this took a bit of experimenting...

edit - also, here's MarketWatch on ET

https://www.marketwatch.com/investing/stock/et

You might consider adding Altria (MO) to that list. 8.69% dividend.

Cheers, much nicer!

Okay I guess ET isn't as bad as I was first reading about. Energy is its own animal with its own independent-from-the-market volatility, which is a real love/hate for me.

MO: $40.73/$6.62 (6.2:1)

Again, dividends over two years, which I thought would be good to catch a good year plus a turbulent year, though this turbulent year really doesn't seem that bad as far as dividends are concerned, so maybe it should just be the last 12mo..

scootergmc

old and slow

- Joined

- Aug 14, 2003

- Location

- Land of cows and silage

- Moto(s)

- Honda HT3813 (x2), Cub Cadet 147,

Oliver 1655, Super 88,

Cat 15 (x2)

It sounds like you're shying from a single stock or sector specific... You'd prefer a somewhat diversified fund, correct?

It sounds like you're shying from a single stock or sector specific... You'd prefer a somewhat diversified fund, correct?

Lotta different interests one can have with dividends, but my thoughts are based around retirement income, which yes I know you're not really supposed to count on, but sometimes there's not much of a choice. Knowing that, you can't entirely go with super safe stocks, because they don't yield much, then you can't go high risk, because you're going to screw yourself at an important time in life. Just trying to find that balance, which yes I do think is better suited to more diversified funds to reduce the impact of some random issue to a specific business. Still gotta pay the bills even though some salmonella outbreak at CMG has everyone shitting their pants.

jt2

Eschew Obfuscation

Dividend stocks also tend to weather downturns a bit better, which should be a consideration right now, IMO. I like dividend aristocrats right now, like VIG

NorCalAthlete

O_o

As far as I can see, ET is almost certainly going to cut dividend shortly.

Completely? Or just reduce?

afm199

Well-known member

Completely? Or just reduce?

Reduce for sure. Eliminate, i doubt. hard to say. Energy funds and stocks are so incredibly volatile that I basically gave up on them long ago. I own Exxon and some others through index funds, but I no longer buy them. Just too incredibly volatile, as the price charts show all too well.

- Status

- Not open for further replies.