-

There has been a recent cluster of spammers accessing BARFer accounts and posting spam. To safeguard your account, please consider changing your password. It would be even better to take the additional step of enabling 2 Factor Authentication (2FA) on your BARF account. Read more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Thread 2019

- Thread starter afm199

- Start date

FXCLM5

bombaclaud

a lil late but did you see wtf beyonce did?

fuck wished my significant other had the knowhow/balls/desire to do that - she traded a $6 mil performance for uber stock back in 15 and now when it ipo'ed, her 6 became 300 mil

arty

arty

fuck wished my significant other had the knowhow/balls/desire to do that - she traded a $6 mil performance for uber stock back in 15 and now when it ipo'ed, her 6 became 300 mil

Last edited:

afm199

Well-known member

My take on the current market is that stocks are going to be in the doldrums for a while, and bonds will do well. The Saint Louis head Fed, Bullard, just said a rate cut is imminent. Apparently good old QE is alive and well.

yeah, inflation is below 2%. the fed doesn't feel the threat of inflation right now.

meanwhile morgan stanley predicts a recession in 9 months if the stuff about the tariffs drags on ...

i buy more of which ETFs are doing well in my portfolio. right now, the bond ETFs are doing so much better

meanwhile morgan stanley predicts a recession in 9 months if the stuff about the tariffs drags on ...

i buy more of which ETFs are doing well in my portfolio. right now, the bond ETFs are doing so much better

Last edited:

afm199

Well-known member

yeah, inflation is below 2%. the fed doesn't feel the threat of inflation right now.

meanwhile morgan stanley predicts a recession in 9 months if the stuff about the tariffs drags on ...

i buy more of which ETFs are doing well in my portfolio. right now, the bond ETFs are doing so much better

Yup, ditto. I've been smiling about that, I got out of about 1/3 of my equity positions for bond ETF's a little while back.

Ducky_Fresh

Treasure Hunter

Might need to wait for a little recover after this week and last..

If looking for something to invest in and hold for a few years, I think you'll find the best value in companies recently hurt most by the trade wars.

How about lithium mining and manufacturing in Australia, now that China is going to cut down on production? Lots of possibilities and opportunities in the supply chain

Blankpage

alien

Might need to wait for a little recover after this week and last..

I got one foot out my office window, thinking about jumping

afm199

Well-known member

I got one foot out my office window, thinking about jumping

Must be smiling today

rodr

Well-known member

How about lithium mining and manufacturing in Australia, now that China is going to cut down on production? Lots of possibilities and opportunities in the supply chain

I think you mean rare earth elements? China is not a major lithium producer. With rare earths you're in a world of geopolitical price manipulation and I have no clue.

you're keeping me on my feet, rodr!

I was driving around this weekend, listening to the tail-end of a news-talk radio interview. about China slowing down on the mining and manufacturing of some elements that are crucial in the manufacturing of electronics.

I erroneously connected that to the recent talk about Australia's advantage of being a lithium producer for batteries which China is an importer of

https://www.bloomberg.com/news/features/2019-06-03/lithium-miners-australia-chile-see-riches-as-ev-battery-makers

... all I know is, there is so much change going on, it would be too time-consuming for me to ever stay on top of which business is succeeding and which businesses are at the mercy of the supplier of "ingredients" of what they produce. that's why i never invest in individual stocks in companies. i don't have the time to analyze which companies will be impacted by changes beyond their control.

I was driving around this weekend, listening to the tail-end of a news-talk radio interview. about China slowing down on the mining and manufacturing of some elements that are crucial in the manufacturing of electronics.

I erroneously connected that to the recent talk about Australia's advantage of being a lithium producer for batteries which China is an importer of

https://www.bloomberg.com/news/features/2019-06-03/lithium-miners-australia-chile-see-riches-as-ev-battery-makers

Scraping a shovel into a patch of dirt near the Australian port city of Bunbury in March, an executive for U.S.-based lithium leader Albemarle Corp. heralded a A$1 billion ($690 million) plan to build the world’s biggest processing plant of its type. Meanwhile, in Mejillones, northern Chile, South Korea’s Samsung SDI and Posco are planning to jointly develop a facility to make chemical components used in batteries.

“Chile and Australia have the advantage,” said Daniela Desormeaux, chief executive officer at Santiago-based consulting firm SignumBOX. They have the lithium and “at the same time state incentives, so companies transforming the raw material can set up shop there."

... all I know is, there is so much change going on, it would be too time-consuming for me to ever stay on top of which business is succeeding and which businesses are at the mercy of the supplier of "ingredients" of what they produce. that's why i never invest in individual stocks in companies. i don't have the time to analyze which companies will be impacted by changes beyond their control.

Last edited:

Ducky_Fresh

Treasure Hunter

It feels like last summer. Turbulent but generally flat with lots of money changing hands. Things should calm down as summer ends then in to the dumps but this time no gimmick rescue plans.

I keep hearing a lot about how things are drastically over valued and lots of dot com comparisons. Kind of makes sense with Uber or lyft or crowd strike or slack or zoom. These companies shouldn’t be worth $15-30B with $100-400m in revenue. It’s insane shit for small magnitude revenue. Nothing like amazon at 100x but 30B in revenue years ago...

I’ll be taking a hard look at those stable funds since we’re hitting peaks. I mean where the fuck does this stop going up???

I keep hearing a lot about how things are drastically over valued and lots of dot com comparisons. Kind of makes sense with Uber or lyft or crowd strike or slack or zoom. These companies shouldn’t be worth $15-30B with $100-400m in revenue. It’s insane shit for small magnitude revenue. Nothing like amazon at 100x but 30B in revenue years ago...

I’ll be taking a hard look at those stable funds since we’re hitting peaks. I mean where the fuck does this stop going up???

Ducky_Fresh

Treasure Hunter

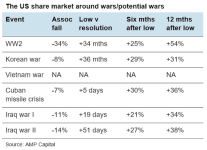

PS- Someone remind me what happens when we go to war? Generally a false stimulus at the beginning then recession due to uncertainty, followed by good times post “recovery”?

Entoptic

Red Power!

Speaking of diversification, anyone own FGMNX Fidelity GNMA Fund? It's done well recently.

I went ahead and bought some this morning.

It's above the 200 however large volume candles are all red and it's also at the top of the range. If it break through then you should see some good gains however since it is at the top of the range the risk is large. It couldn't break past this point from Dec 16' to Oct 17' which means a lot of resistance is at that level and the fake breakout on the weekly and three daily candles of red don't make it look so hot.

I'll post pics later to back up my view. What was your reason for investing? I haven’t looked into this too much and this is my first thought on it. Is there news on it?

Last edited:

Entoptic

Red Power!

PS- Someone remind me what happens when we go to war? Generally a false stimulus at the beginning then recession due to uncertainty, followed by good times post “recovery”?

Very interesting topic.

Attachments

Ducky_Fresh

Treasure Hunter

Does anyone else speculate this recession before summer ends? What can we hypothesize it looking like?

Blankpage

alien

The last 8 years people have been preaching recession and market being overbought.

It's been engineered for gains using every tool available. Will probably end bad at some point but I think it still has legs until the election is over.

It's been engineered for gains using every tool available. Will probably end bad at some point but I think it still has legs until the election is over.

Entoptic

Red Power!

The last 8 years people have been preaching recession and market being overbought.

It's been engineered for gains using every tool available. Will probably end bad at some point but I think it still has legs until the election is over.

I agree. The writing is on the wall however I don't see anything coming anytime soon. The cracks are starting to appear but I don't see any momentum yet, it's building.

afm199

Well-known member

Does anyone else speculate this recession before summer ends? What can we hypothesize it looking like?

Could be a year or two away. I'm not smelling any recession yet.

Or not.